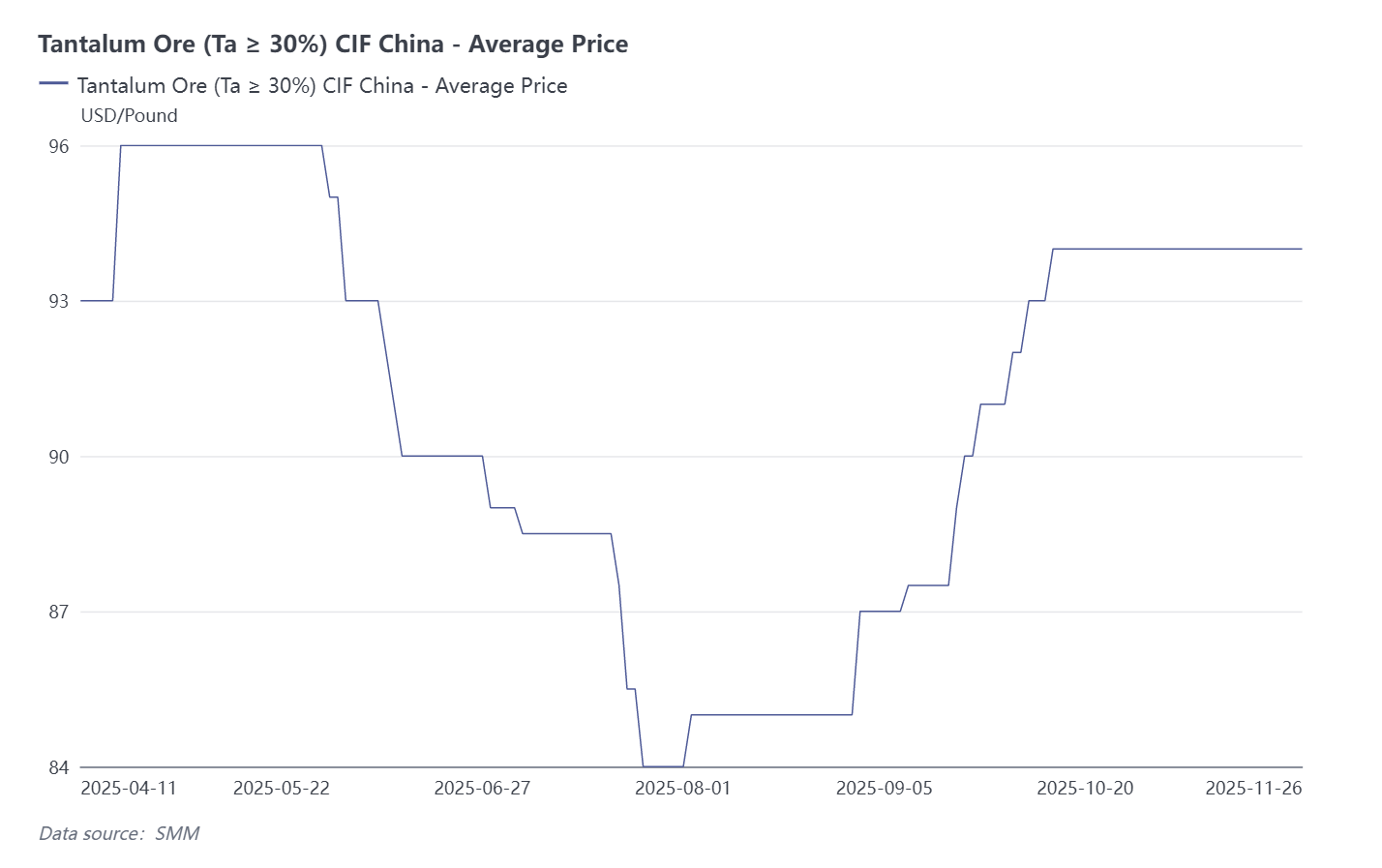

Recently, the situation in the Democratic Republic of the Congo (DRC) has escalated again, adding further uncertainty to the market supply of tantalum ore. Upon the release of this news, bullish sentiment among industry insiders has reignited. Can the CIF price of Chinese tantalum ore (Ta2O5≥30%) sustain the upward trend seen at the start of the year and break through the "100$ mark" in one fell swoop?

News Background

On November 16th, the DRC's Ministry of Mines announced that it had extended by six months the ban on mineral trade at 38 small-scale mines in North Kivu and South Kivu provinces affected by conflicts. The ban prohibits the mining and export of minerals from these mining areas, and the ministry stated that these sites may face independent audits by the Ministry of Mines or international bodies including the United Nations (UN) and the Organisation for Economic Co-operation and Development (OECD).

First implemented in February this year, the ban will remain in effect due to evidence that illegal supplies from these mines are funding armed groups in the eastern region. These mines produce tantalum-niobium ore, cassiterite, and wolframite (raw materials for tin, tantalum, and tungsten), and the extension will increase compliance pressures on the global supply chains of tin, tantalum, and tungsten. The Rwanda-supported M23 rebels and other armed groups have occupied mineral-rich areas in eastern DRC.

On November 23rd, the Chinese Ministry of Foreign Affairs and the Chinese Embassy in the DRC issued an urgent security alert, requiring Chinese citizens and enterprises remaining in high-risk areas of eastern DRC to evacuate immediately. This comes as armed conflicts in the region occur frequently, and incidents of attacks and kidnappings targeting Chinese citizens have surged.

Market Outlook Analysis

As core strategic minerals for the semiconductor, new energy, and other sectors, tantalum-niobium ore supply chains have seen significantly heightened instability globally due to the M23 armed group's control over relevant mining areas in the DRC. The scramble for mineral interests is the core of the conflict between the M23 armed group, the DRC government, and neighboring Rwanda, and this key divergence is further exacerbating the security situation on the ground. Meanwhile, the DRC accounts for 43% of global tantalum ore supply, and the border area between North Kivu and South Kivu provinces controlled by the M23 is precisely the core enrichment zone for coltan (columbite-tantalite). Among these, the Rubaya Tantalum Mine, one of the largest tantalum mines in the DRC, contributes 15%-20% of global coltan production. As a result, the ongoing conflict in the DRC has dealt a severe blow to the stability of global tantalum ore supplies. According to local tantalum ore miners, the current transportation of minerals out of the DRC faces significant obstacles, and relevant parties are still negotiating transportation arrangements.

Notably, data released by the General Administration of Customs shows that currently, 9% of China's total tantalum ore imports come from the DRC, meaning the direct impact is relatively limited. While some DRC tantalum ore is smuggled to Nigeria before entering China, the specific proportion of such sources remains unclear. Additionally, considering that China's import dependence on overseas tantalum ore is as high as 78%, leading domestic tantalum smelting enterprises have stockpiled raw materials in advance to ensure stable production. Public information indicates that the raw material inventories of some leading enterprises can support stable production for up to one year. In this context, fluctuations in DRC's tantalum ore supply may drive up tantalum ore prices due to tight supply expectations, but from the current market structure, this conflict will not trigger a shortage crisis for downstream end products for the time being.

![Baiyin Nonferrous Group Co., Ltd. Copper Tendered 1 mt of Tellurium Ingots [SMM Report]](https://imgqn.smm.cn/usercenter/cgspx20251217171725.jpg)

![[SMM Analysis] Titanium Dioxide Prices Rise Post-Holiday, Geopolitical Risks Cloud Export Outlook](https://imgqn.smm.cn/usercenter/NPpAM20251217171723.jpeg)